Irs tax estimator 2021

We can also help you understand some of the key factors that affect your tax return estimate. Our free tax calculator is a great way to learn about your tax situation and plan ahead.

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

Then get Your Personal Refund Anticipation Date before you Prepare and e-File your 2021 IRS.

. Estimate Your Taxes For Free And Get Ahead On Filing Your Tax Returns Today. Use the PriorTax 2020 tax calculator to find out your IRS tax refund or tax due amount. Tax Calculator for 2021 Returns 2021 Returns can no longer be e-filed as of October 17 2022.

IRS. Use this Calculator for Tax Year 2021. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

IRS tax forms. Enter your tax information to the best of your knowledge. As you make progress the taxes you owe or the.

Based on your 2021 tax info well use the lower of the following IRS-approved methods to calculate your estimated tax payments. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. This tool helps people make sure their employers are.

See What Credits and Deductions Apply to You. Marginal tax rate 22 Effective tax rate 1198 Federal income tax 8387 State taxes Marginal tax rate 633 Effective tax rate 561 New York state tax 3925 Gross income 70000 Total. Estimate your 2021 Return first before you e-File by April 18 2022.

Ad Estimate Your Tax Refund w Our Tax Calculator. Estimate Your Taxes For Free And Get Ahead On Filing Your Tax Returns Today. In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100.

Estimate the areas of your tax return where needed. Personal Finance Insiders free federal income tax calculator estimates how much you may owe the IRS or get back as a refund when you file your 2021 tax return. Ad Estimate Your Tax Refund w Our Tax Calculator.

Plan Ahead For This Years Tax Return. Start a New 2021 Tax Return. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is.

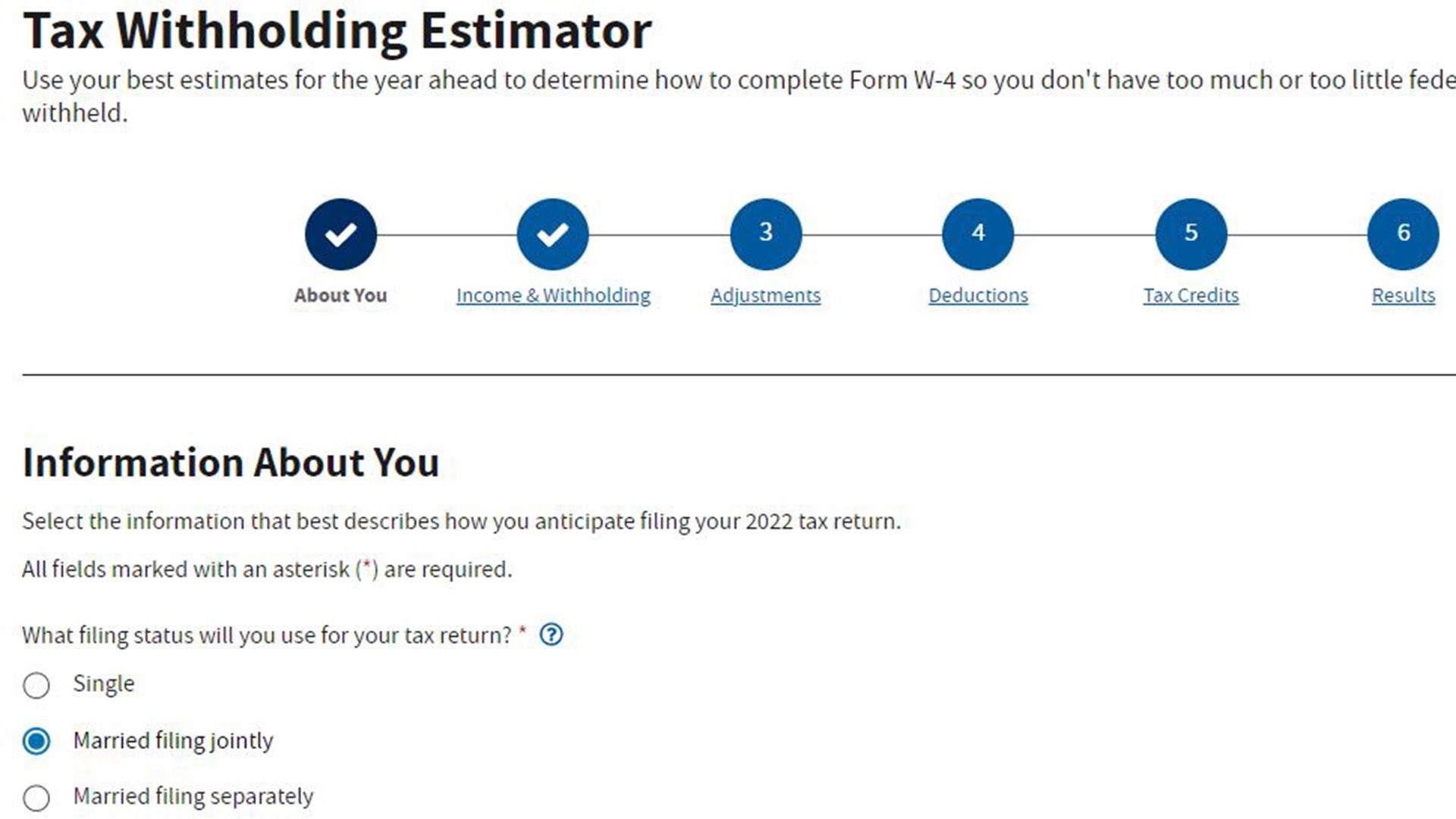

Taxpayers whose employers withhold federal income tax from their paycheck can use the IRS Tax Withholding Estimator to help decide if they should make a change to their. IRS Tax Tip 2021-98 July 8 2021 All taxpayers should use the IRS Tax Withholding Estimator to check their withholding. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. 2021 Tax Return Estimator Calculator.

Tax Refund Calculator TAXCASTER Tax Calculator 2021 Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Calendar year farmers and fishermen. IR-2022-81 April 13 2022 WASHINGTON The Internal Revenue Service today urged any taxpayer now finishing up their 2021 tax return to use the IRS Tax Withholding.

Know your estimated Federal Tax Refund or if. By using this site you agree to the use of cookies. This site uses cookies.

90 of your estimated 2022 taxes. If youre a calendar year taxpayer and at least two-thirds of your gross income for 2021 or 2022 is from farming or fishing you have only one payment due. Ad Enter Your Tax Information.

2020 Simple Federal Tax Calculator Enter your filing status income deductions and. As of 2020 the IRS launched a new Tax Withholding Estimator to simplify the process of finding out the correct amount of tax to withhold during the year. Beyond this date use the 2021 Tax Return Calculator below to estimate your return before.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

This calculator computes federal income taxes state income taxes social. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. Plan Ahead For This Years Tax Return.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2021 Irs Tax Bracket Internal Revenue Code Simplified

New 2021 Irs Income Tax Brackets And Phaseouts

How To Keep Your 2022 Irs Tax Refund Money Now Rather Than Wait King5 Com

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Tax Calculator Cheap Sale Save 46 Civilsamhallespodden Se

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

1 Uk Income Tax Calculator 2016 Salary Calculator Since 1998 Gross Salary Of 12000 2016 2016 201 Salary Calculator Income Tax Student Loan Repayment

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Make Your Form2290filing Easy And Secure With The Help Of The Provided Irsform2290taxfiling The Free Gross Weight Of Your Vehicle Wi Irs Forms Irs Taxes Etax

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Tas Tax Tip Paying The Irs Tas

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service

Infographics Will I Owe The Irs Tax On My Stimulus Payment